Fundraising Expenses Vs Administrative Expenses

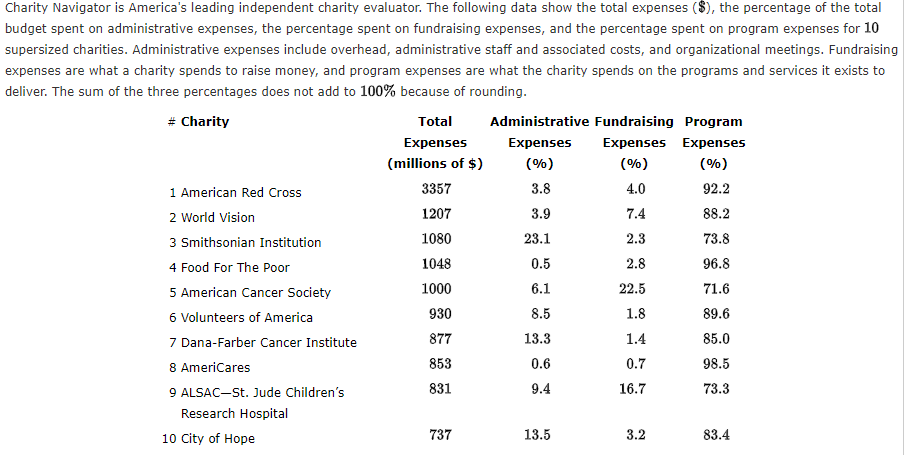

Consistent with generally accepted accounting principles gaap some organizations report a portion of their specific joint costs from combined educational campaigns and fundraising solicitations as program costs those that follow sop 98 2 or asc 958 720 45. Our data shows that 7 out of 10 charities weve evaluated spend at least 75 of their budget on the programs and services they exist to provide.

3 8 88 2 Charity Navigator Is America S Leading In Chegg Com

Which are normally reported separately as deductions from the proceeds of the event.

Fundraising expenses vs administrative expenses. These are the costs that are directly related to carrying out. Examples of these expenses are the costs of holding a fundraising event solicitation of contributions or salary of individuals involved in the fundraising process. The proportion of these costs to overall budget as discussed in a number of other articles in this issue is under increasing scrutiny at least by watchdog organizations.

These costs pertain to running the. Just as a for profit business subtracts costs from revenue to figure its profits your nonprofit has to subtract fundraising expenses from fundraising income. Together administrative expenses and fundraising expenses make up a nonprofits overhead or operating expenses the irs does not require that nonprofits spend any particular portion of their income on each category.

If a fundraising drive brings in 15000 but it cost you 10000 in advertising events and mailing to members youve only made 5000 above your costs. Two types of costs related to fundraising activities are not usually reported as such. Fundraising expenses fundraising costs are associated with soliciting others to contribute money or other property time or the use of facilities or other property for which the contributor will receive no direct economic benefit.

Costs of accounting for contributions which like most accounting costs are considered an administrative expense. It just wants nonprofits to report how they spend their money. And costs of direct benefits such as food to attendees at fund raising events such as dinners golf parties etc.

Fundraising expenses for nonprofit organizations program expenses. These costs can include expenses of personnel consultants rent printing. General and administrative expenses are not directly attributable to the production of goods and services and include audit fees legal fees rent and utilities.

Percent of total functional expenses spent on programs and services higher is better program expenses less than 333. Joint cost allocation adjustment. Management and general mg expenses along with fundraising expenses constitute an organizations overhead costs.

And 9 out of 10 spend at least 65. Fundraising these are costs of all activities that relate to an appeal for financial support or for a contribution to an organization. These are the costs associated with making appeals for financial support.

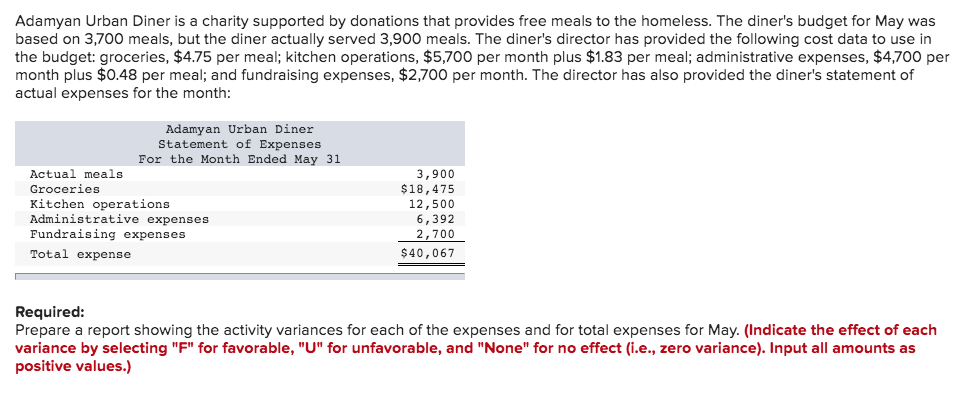

Solved Adamyan Urban Diner Is A Charity Supported By Dona

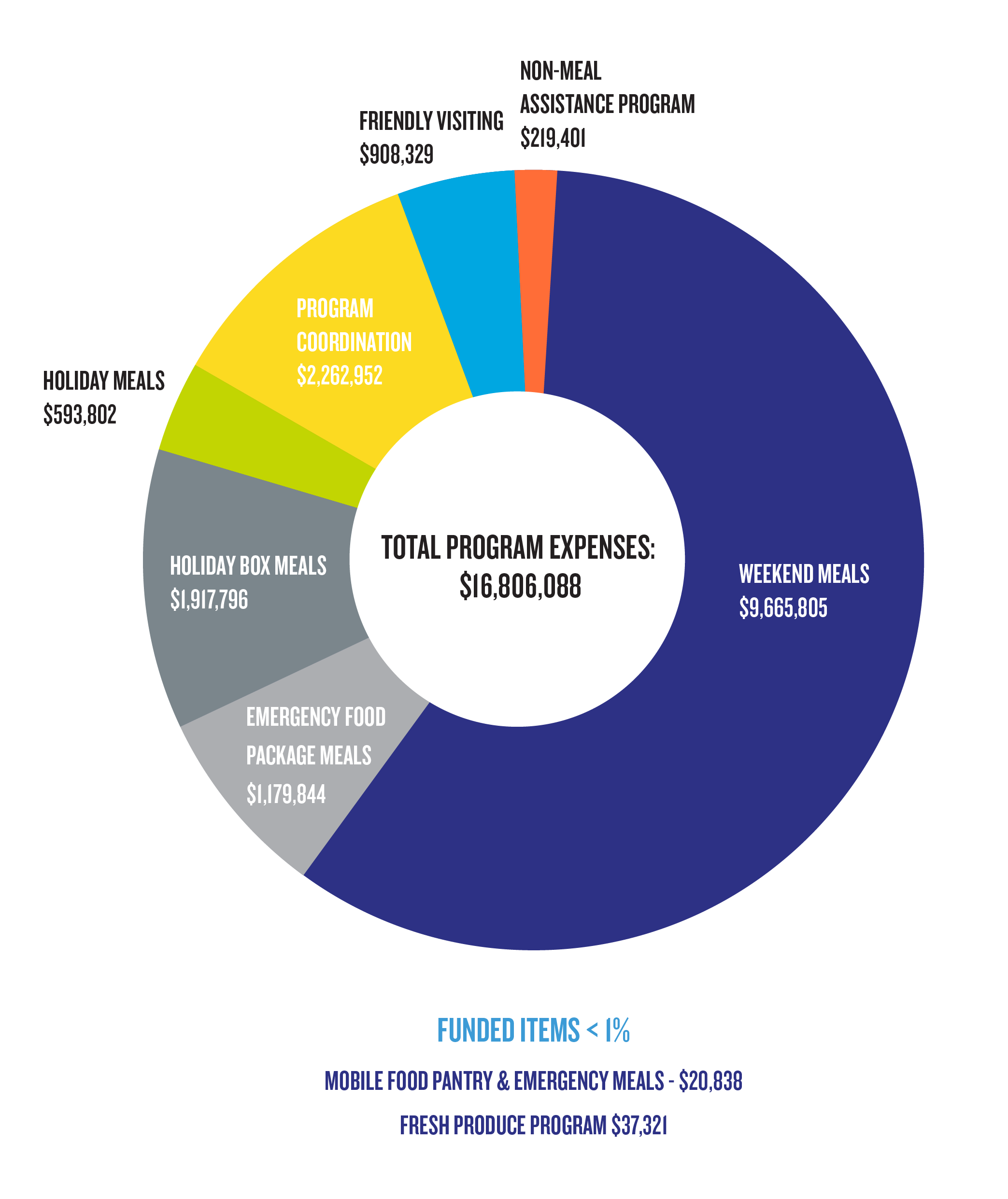

Where Do Donations Go Find Out In Our Annual Report Our Little

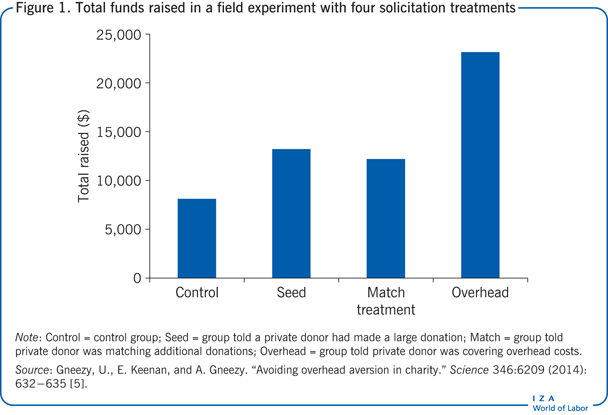

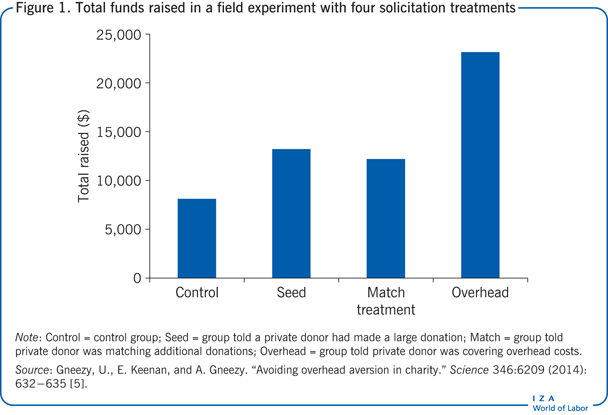

Iza World Of Labor Are Overhead Costs A Good Guide For

Financial Information Citymeals On Wheels

Saas G A Expense Is Surprisingly High Opexengine

Https Dpi Wi Gov Sites Default Files Imce Sms Choice On Demand Training Training 205 4 20net 20eligible 20education 20expenses Pdf

20 Charities You Need To Know About How To Choose The Right One

True Program Costs Program Budget And Allocation Template And

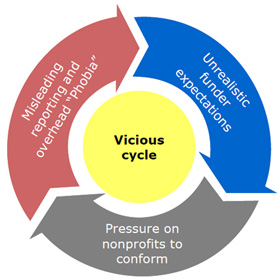

Nonprofit Overhead Costs Breaking The Vicious Cycle Of Misleading