Are Funeral Expenses Tax Deductible

Funeral expenses are recognized as legitimate estate tax deductions subject to certain rules. This cost is only tax deductible when paid for by an estate.

03 Chapter 4 Deductions From Gross Estate Part 01

Funeral expenses are not tax deductible.

Are funeral expenses tax deductible. They are never deductible if they are paid by an individual taxpayer. The irs states that no individual taxpayer can deduct for death related expenses but that doesnt exclude estates from being able to. Not all funeral expenses can be deducted and some charges may be denied by the irs.

Deducting funeral expenses as part of an estate. Estates with net values that dont reach exemption thresholds cant deduct funeral expenses because it serves no purpose. For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form.

If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. Funeral and burial expenses are only tax deductible when paid by the decedents estate and the executor of the estate must file an estate tax return and itemize the expenses in order to claim the deduction. No never can funeral expenses be claimed on taxes as a deduction.

Many estates do not actually use this deduction since most estates are less than the amount that is taxable. In other words funeral expenses are tax deductible if they are covered by an estate. According to internal revenue service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return.

Funeral expenses are not tax deductible because they are not qualified medical expenses. The estate itself must also be large enough to accrue tax liability in order to claim the deduction. Each year taxpayers ask can i deduct funeral expenses and the answer unfortunately is usually not as an individual.

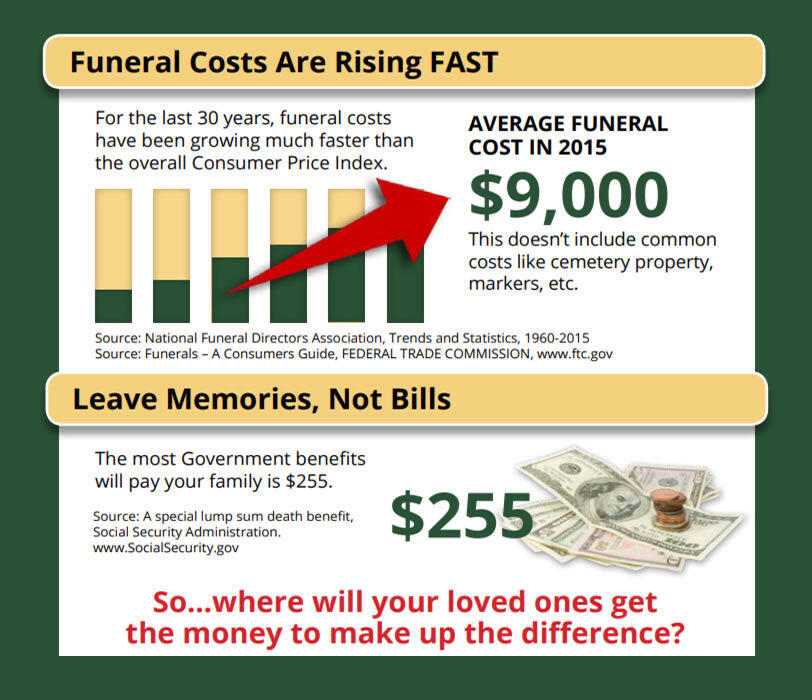

The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. Funeral and burial costs are not cheap.

In short these expenses are not eligible to be claimed on a 1040 tax form. Funeral expenses that are not tax deductible are any which are not paid by the deceased persons estate. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

As stated by the irs paying for funeral or cremation expenses out of your pocket are not tax deductible. The irs deducts qualified medical expenses.

Corporate Life Insurance Opportunities To Die For

5 Tax Deductible Expenses Every Executor Should Know Fifth Third

Claiming Funeral Expenses As Tax Deductions

2020 Breakdown Of Average Funeral Costs Cremation Burial Etc

Tax Wealth Advisor Alert Irc Section 139 How Employers Can

:max_bytes(150000):strip_icc()/outdoor-shot-of-funeral-104305070-013400d1e1d54ee09134b40c0ac6ea26.jpg)

How Much Can You Claim For Funeral Expense Deductions

Coronavirus Tax Free Section 139 Benefits Silver Lining On The

18 Medical Expenses You Can Deduct From Your Taxes Gobankingrates

Clearance Certificate Death Canada Ca Funeral Expenses Video